Quebec 2022 Budget Highlights

On March 22, 2022, the Quebec Minister of Finance announced Quebec’s 2022 budget. This article highlights the most important things you need to know.

No Changes To Corporate or Personal Tax Rates

There are no changes to the province’s corporate tax rates or personal tax rates in Budget 2022.

One-Time Cost Of Living Tax Credit

Budget 2022 includes a one-time refundable tax credit of $500 for individuals 18 and over who had a net income below $100,000 in 2021. This tax credit will be gradually reduced for individuals with a net income between $100,000 and $105,000. It will not be available to anyone with a net income of over $105,000.

This tax credit will be paid out after Revenu Québec has processed your 2021 personal income tax return.

No Interest On Student Loans

Budget 2022 includes a provision that the government will cover the interest costs on student loans from April 1, 2022, to March 31, 2023. While this will not necessarily decrease monthly payments for student loan holders, this will enable them to reduce the principal of their loans faster.

Investment and Innovation Tax Credit (C3i) Has Been Extended

The purpose of the tax credit for investment and innovation (C3i) is to provide incentives for companies to invest in manufacturing, processing, or computer equipment.

It was increased in the 2021-2022 budget, with the tax credit for eligible expenses being doubled. This increase was scheduled to end on December 31, 2022, but has now been extended for an additional year until December 31, 2023.

Major Cultural Donations Tax Credit Deadline Abolished

The Major Cultural Donations tax credit, introduced in July 2013, originally had a deadline of January 1, 2023, for donors to be eligible for an additional 25% tax credit for major cultural gifts. The legislation for this tax credit will be amended, so there is no longer a deadline. The tax credit will be permanent for donations of at least $5,000 and up to $25,000. The maximum tax credit someone can claim is $6,250.

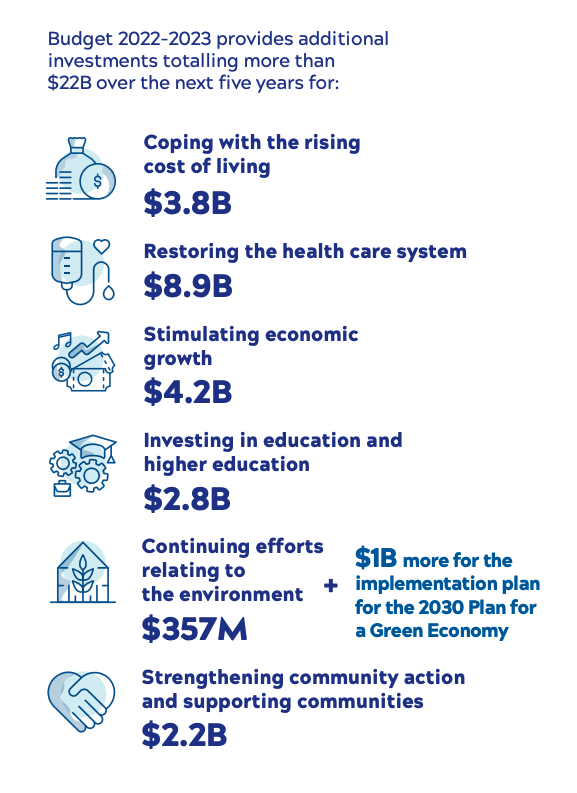

Continuing To Support Communities, Healthcare, and Education

Budget 2022 affirms the government’s commitment to investing in healthcare, higher education, and our communities. Budget 2022 includes the following commitments:

-

$8.9 billion to rebuild the healthcare system.

-

$4.2 billion to stimulate economic growth.

-

$2.8 billion to support education, including higher education.

-

$2.2 billion to strengthen community action and support communities.

We can help!

Wondering if this year’s budget will impact your finances or your business? We’ll help you sort things out – give us a call today!

Recent Comments